According to Gartner, 87% of senior business executives consider the adoption of digitalization initiatives to be a priority. The need for professional service companies to go digital can be assessed by considering three parameters: their clients’ expectations, their employees’ challenges, and how these two factors combine to impact the company’s growth.

Client expectations from professional service firms have changed in recent years due to the impact of the pandemic. Increasingly, they prefer digital delivery over face-to-face interaction. They also want professional service firms to help them manage their cybersecurity risks and restructure their businesses in ways that respond effectively to the changing digital world.

Rather than viewing new technologies such as artificial intelligence, machine learning, and blockchain as threats to the profession, clients look at them as opportunities and want professional firms to assist in achieving these digital goals.

With Gartner reporting that remote workers will make up 32% of the global employee workforce by the end of of 2021, both firms and employees are speeding up their digital transformation efforts. A large share of employees recognize the need to adapt and change their selling style, and they also have confidence in the ability of their firms to equip themselves digitally.

Forbes states that 84% of business digital transformation initiatives fail due to a lack of operational dynamism, and poor visibility of the drivers and challenges of digital transformation.

According to the 2020 Harvard Business Review, 84% of business executives say that the introduction of digital transformation initiatives has led to the emergence of new and prospective business opportunities.

Firms in this scenario take swift action to invest in new technologies, leading them down a fast track to digitization. Evidence also shows that such firms have recovered better from the impact of the pandemic than those firms where IT executives and business leaders do not see eye-to-eye.

Client Expectations From Professional Firms

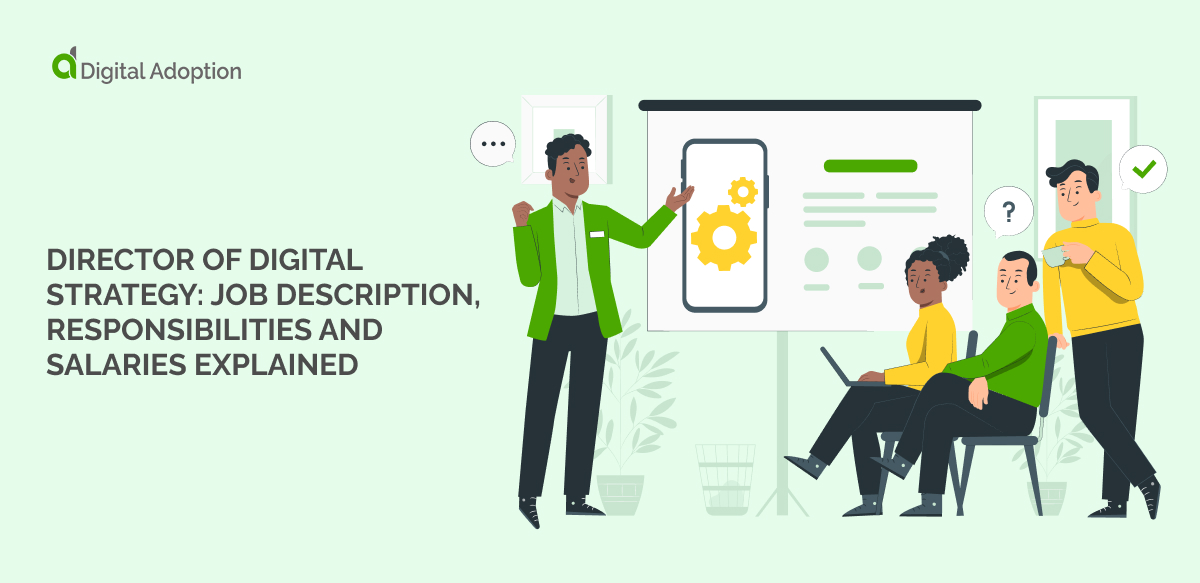

A Financial Times survey was conducted across eight countries among 289 respondents after the outbreak of COVID. The respondents “worked for an organization that has contracted professional services firm over the past 12 months”. The respondents were from Canada, U.S., U.K., France, Germany, India, Singapore, and Australia. The Financial Times is one of the world’s leading news organizations.

The survey results revealed that clients are now looking for professional service firms to be digitally equipped and able to help their companies break through the digital barrier. As shown in chart 1, over 65% of clients wanted their professional service firms to deliver their services digitally.

Chart 1

Clients’ expectations are understandable, given that nearly half expected advice on data privacy and cyber security from their professional firms after the pandemic. About half also want professional firms to advise them on strategies and restructuring their organizations. As both strategy and restructuring require a digital outlook, increasingly, clients prefer professional firms that are more tuned toward modern needs. Chart 2 shows clients’ expectations from professional services firms.

Chart 2

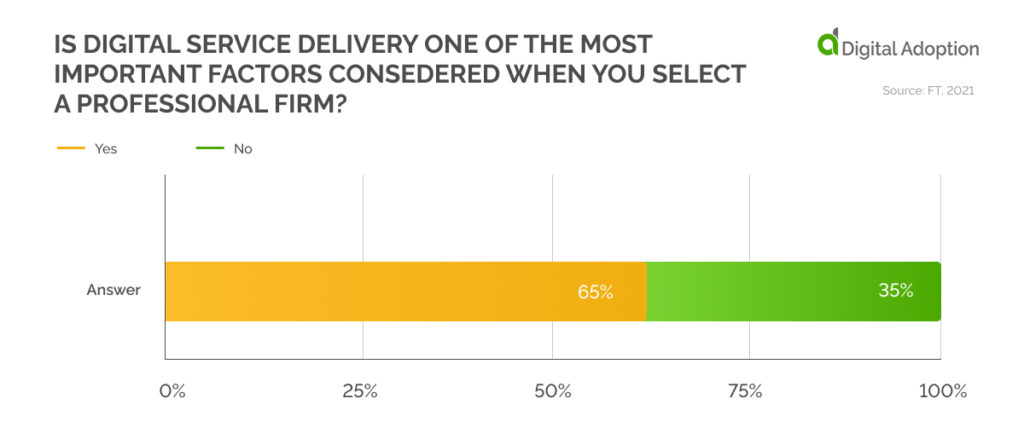

About 52% of all respondents — the second highest percentage among the answers — said that modernizing their digital infrastructure will be an essential strategy for their firm in the next 12 months. Nearly half of the clients (49%) — believe that using artificial intelligence technology is an important next step. Both strategies require the support of a digitally sound professional services firm, reinforcing the need for accelerated digital adoption in such companies. Chart 3 shows the essential strategy clients of professional service firms will follow in the next 12 months.

Chart 3

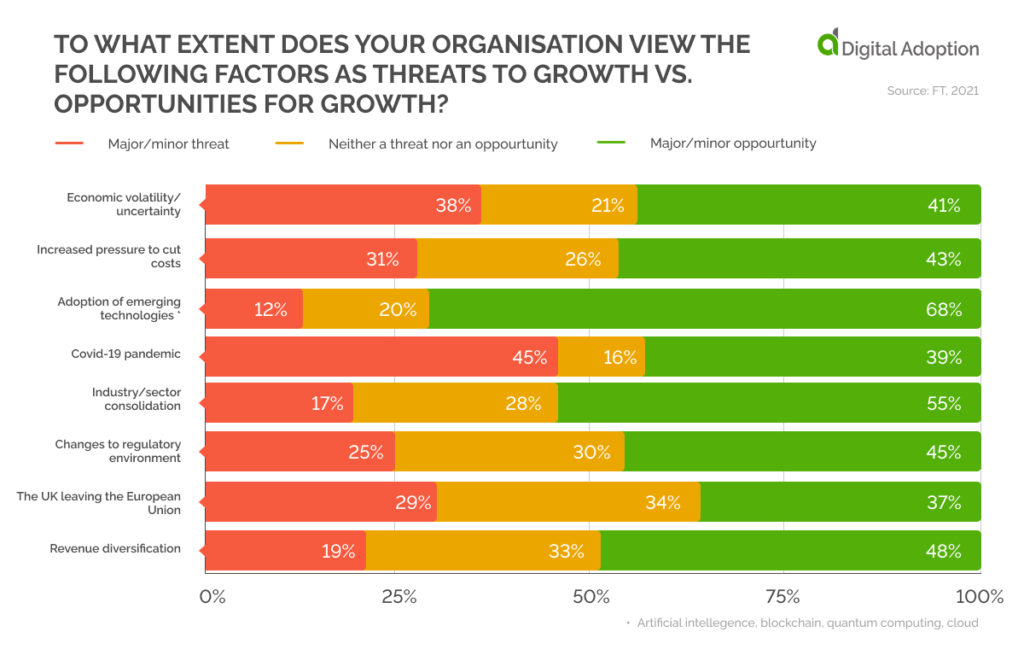

Professional service firms must recognize that clients do not view adopting emerging technologies as a threat—quite the opposite. 68% of clients see new technologies such as AI, blockchain, quantum computing, and cloud computing as major or minor opportunities. This trend is unique as a relatively higher share of clients treats other changes as threats to their growth. For instance, only 40% consider economic volatility and increased pressure to cut costs as opportunities. Only 48-55% consider industry consolidation and revenue diversification opportunities. So, professional services firms are uniquely positioned to leverage their clients’ positive attitudes towards adopting new tech and give mutually beneficial solutions for the problems at hand. Chart 4 shows the views of professional firms’ clients on various factors.

Chart 4

Challenges Faced by Employees of Professional Firms

From May 13 to June 30, 2020, Salesforce conducted a double-blind survey of sales representatives and sales leadership professionals worldwide that attracted 6,000 responses — including 655 from professional services. Salesforce, Inc. is an American cloud-based software company headquartered in San Francisco, California.

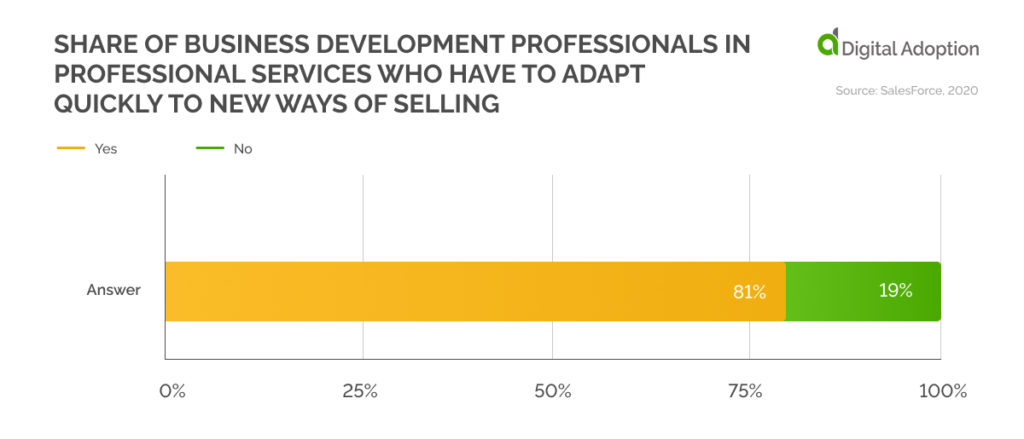

The survey found that most business-side employees in professional firms understood that they needed to adapt their selling styles quickly. Chart 5 shows that an overwhelming majority of the respondents said they needed to learn new ways of selling.

Chart 5

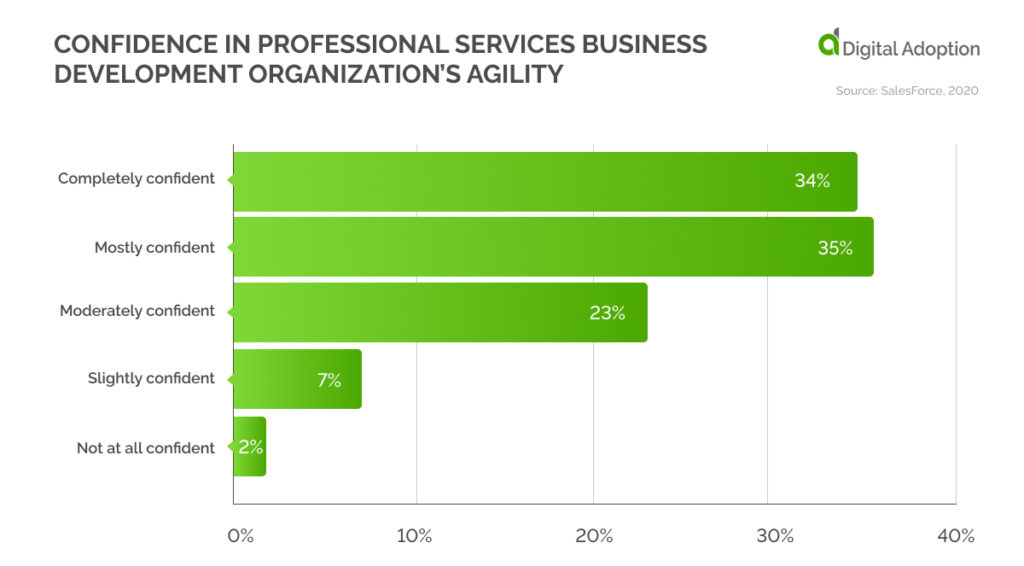

Interestingly, 76% of business professionals surveyed said they feel confident that their professional service firms will remain agile enough to get through the pandemic crisis. Chart 6 shows that nearly 70% of business-side employees were entirely or primarily confident about their firms’ agility.

Chart 6

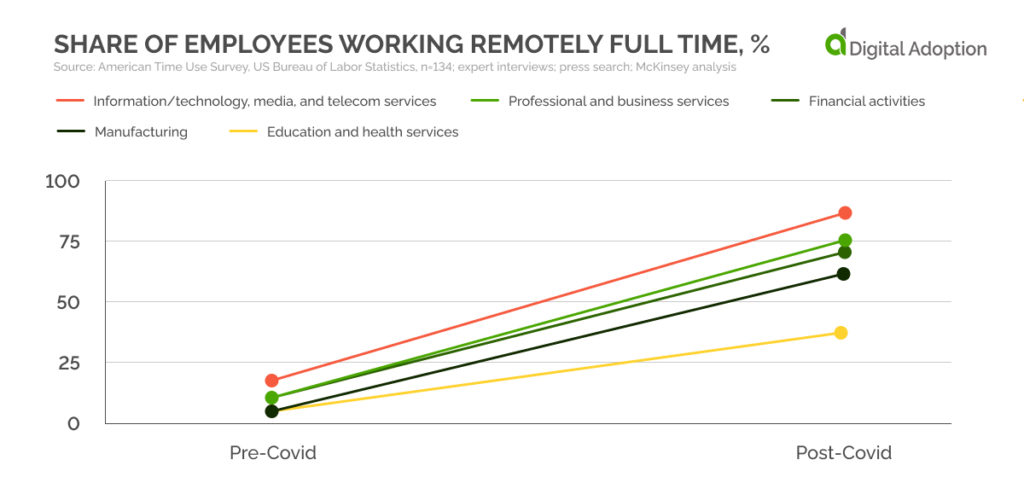

Data from the American Time Use Survey analyzed by McKinsey concludes that nearly 70% of employees in professional and business services are now working full-time from home. This was just a tad below the share of working from home from the IT services. Such a drastic change in the work pattern of the employees needs digital infrastructure support and a technically savvy organization that is not afraid of experimenting with new tools. Chart 7 shows the % share of employees working from home in the U.S. across sectors.

Chart 7

Aspirations and Challenges Faced by Professional Service Companies

The Digital IQ Survey conducted by PricewaterhouseCoopers in the second quarter of 2021 sought responses from more than 1,250 global executives. The survey differentiated the global executives into two types — those firms where the Chief Information Officer and their business partners see eye-to-eye were referred to as Digital IQ leaders in the report. Those who were not in sync were segregated separately. All the metrics in the following graphs follow this pattern.

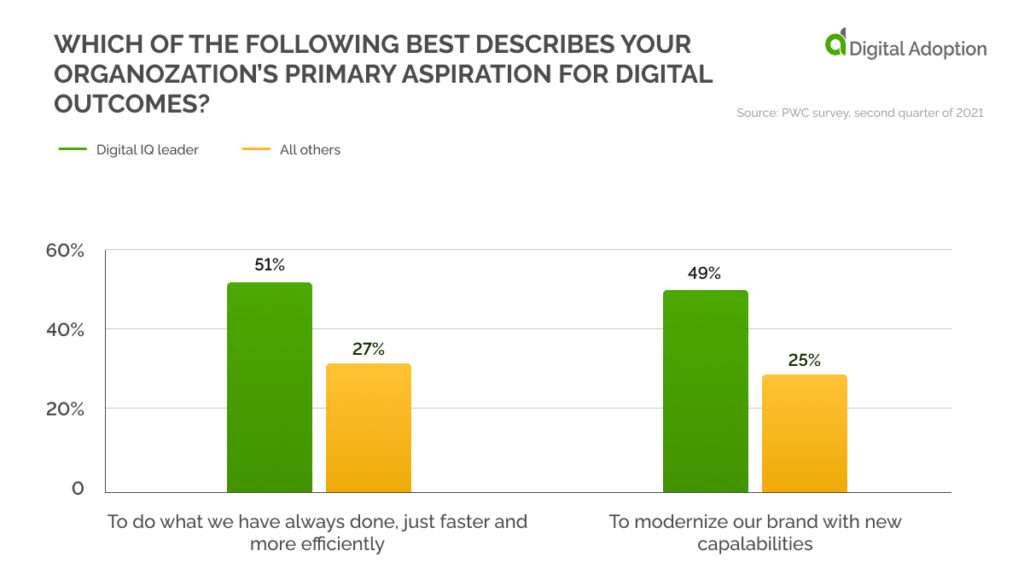

Chart 8 shows that among a small group of IT executives (1/5th of all tech executives in the PWC survey) who see eye to eye with their business peers, close to 50% want to do the existing things faster and more efficiently than before. Close to half of them also want to modernize their brand with newer capabilities. Among those firms where IT executives do not see eye to eye with their business partners, the will to update and to do existing stuff quickly and better was seen only in around 25% of companies — half of the Digital IQ leaders.

Chart 8

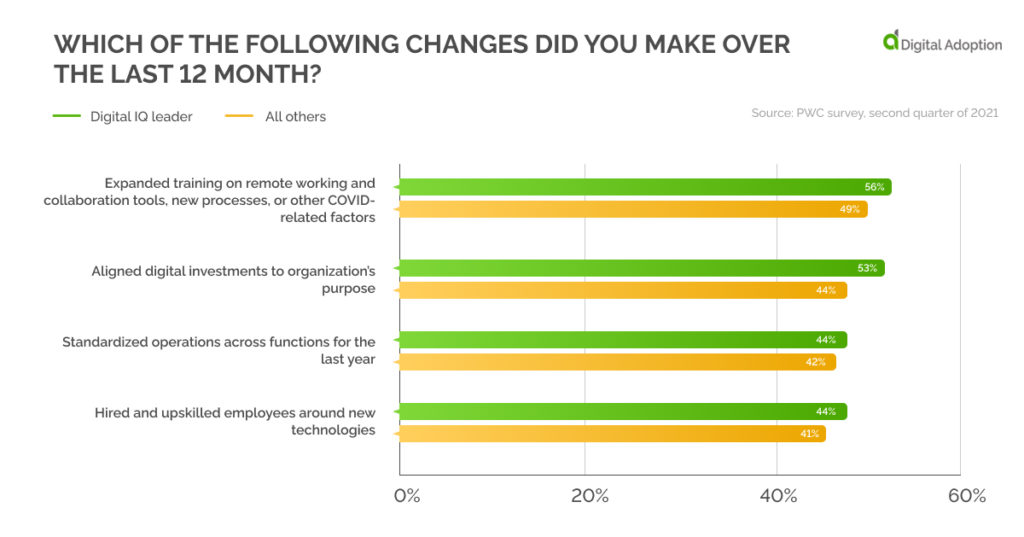

Among Digital IQ leaders, the share of firms that expanded training on remote working to its employees was seven percentage points higher than other firms. A higher share of Digital IQ leaders aligned their digital investments to the organization’s purpose. Also, a higher share hired and upskilled their employees based on new technologies. These conclusions show that the organization performed better in its digital goals in firms where the CIO and business partners think alike. Chart 9 displays these conclusions

Chart 9

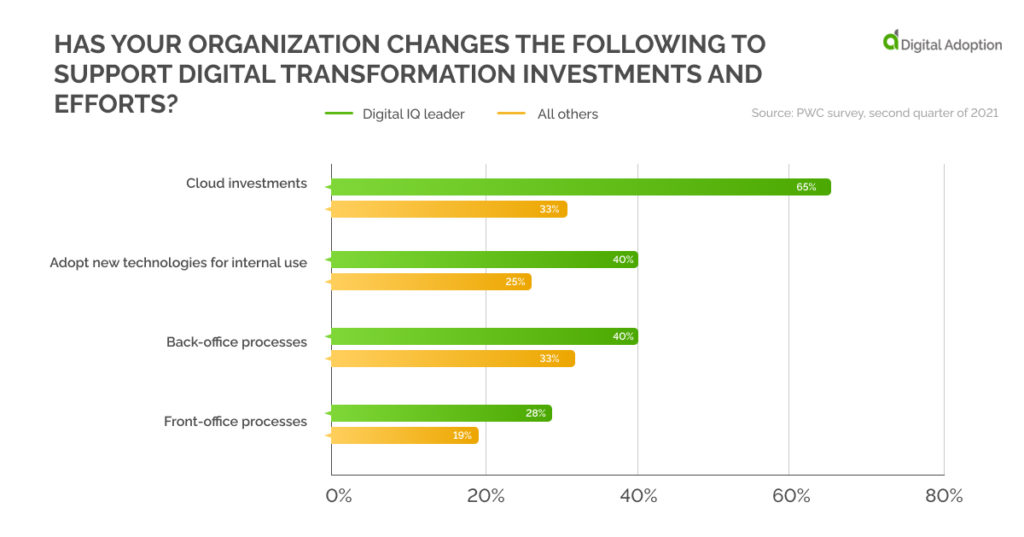

The most damning evidence that Digital IQ leaders were far ahead of their peers came in cloud computing. More than 65% of firms classified as Digital IQ leaders invested in cloud computing, whereas only 33% did. When adapting new technologies, a similar difference was observed between these two types of firms. Chart 10 shows that firms where IT leaders and business professionals are on the same page invest better in digital products.

Chart 10

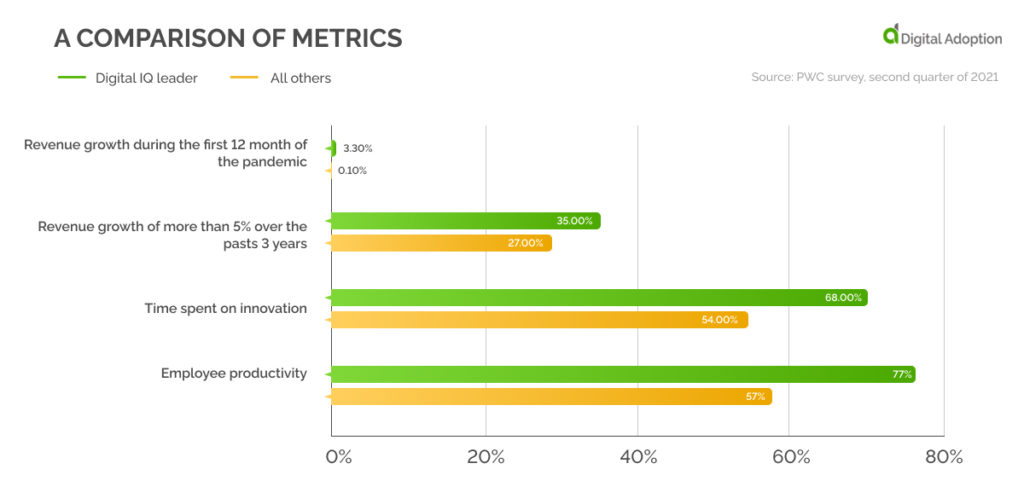

Apart from investments and best practices, a company aims to earn profits. So, it becomes crucial to determine whether having IT executives and business partners on the same page have paid off with higher yields. Chart 11 shows that Digital IQ leader firms had better revenue growth during the first year of the pandemic and the past three years. The time spent on innovation and employee productivity, too, was miles ahead of the other set of companies.

Chart 11

Conclusion

The charts above indicate that companies with solid working relationships between their technology leaders and business partners see faster digital transformation and reap financial benefits. Such companies also inculcated digital values in their employees, who rose to the challenge and equipped themselves in a fast-changing world. And last but not least, the clients expect such a digital transformation from their professional service firms, making this a necessary change.