Digital transformation in the financial services industry is driving change in how customers interact with institutions. Banks are leveraging tools like mobile and digital banking, virtual advisors, and artificial intelligence (AI) to provide a more personalized customer experience.

These technologies will help banks better understand their customers’ needs and deliver tailored products and services that meet those needs. Additionally, banks are using data analysis to reduce costs and increase operational efficiencies. Automation is driving a shift in how banks manage their processes, allowing them to focus on customer service instead of back-office operations.

The industry also leverages blockchain technology for secure payments, identity management, and smart contracts. This technology enables real-time transaction processing, faster settlement times, improved customer experience, and increased data accuracy.

This article will introduce the importance of digital adoption in the banking industry. It will explain digital transformation, why it is so important for financial institutions, and the challenges many companies will face when implementing a DX program.

Digital Transformation Efforts Are Worth It For Financial Service Providers

Digital transformation in financial services companies has a proven track record of adapting businesses to the challenges of an ever-changing marketplace.

The financial services industry was initially slow to embrace the opportunities of new technologies. For example, a 2019 Gartner report suggested that only 12% of financial organizations had reached digital maturity. However, finance companies have now demonstrated the power of digital transformation across their business activities.

FinTech solutions can help financial services companies provide innovative products and solutions to their customers. Insurance companies, banking institutions, and investment organizations benefit from digitizing processes like customer identification, claims management, anti-fraud systems, and financial advice.

And Behind the scenes, digital transformation enables financial services organizations to provide employees with more engaging user experiences and better tools for collaboration.

What Is Digital Transformation (DX)?

Companies undergo a digital transformation when they implement digital technologies to reduce costs and improve organizational growth. Digital adoption solutions can simplify working life, but leaders need considerable skill to ensure the implementation works. A successful digital transformation requires thorough planning to help every member of an organization discover the benefits of a new digital strategy.

Every digital transformation is a unique journey. A large digital transformation project might include a complete overhaul of IT infrastructure, customer and employee management systems, and a whole raft of policies about data security. On the other hand, a small company may simply be grateful for automated processes at key points in its supply chain.

In general, organizations benefit from digital solutions that automate manual tasks, streamline complex workflows, and keep data flowing securely around an organization. And in financial services companies, digital transformation can have a very positive impact on customer journeys.

A survey from Finder, the UK credit agency, estimated that nearly 20% of people could switch to online-only bank accounts by 2027. The businesses in the financial services sector that don’t keep up with demand risk missing out on a significant part of the market.

Why Finance Digitalization Matters to Financial Services organizations

Digitalization is becoming increasingly important for financial services organizations because it allows them to streamline their processes, maximize efficiency, and reduce costs. By leveraging digital technology, banks, insurers, and other financial institutions can automate complex tasks that were previously done manually or with paper-based systems. This helps to improve accuracy and speed up decision-making.

Additionally, digitalization brings new opportunities for financial institutions to provide innovative services and products that make it easier for customers to access their accounts, manage their budgets and investments, and more. Ultimately, digitalization helps businesses in the financial sector reduce operational costs while providing an improved customer experience.

How Financial Technology (FinTech) Is Penetrating The Financial Services Industry

Financial technology (FinTech) is transforming the financial services industry by enabling companies to integrate digitally-enabled products and services into their offerings. Moreover, FinTech is enabling a whole new ecosystem of apps, websites, and automated services that significantly enhance the customer experience.

Some of the significant areas where FinTech is creating positive digital disruption include:

- Payment software and systems, including PayPal, Wise, Venom

- Crowdfunding platforms like GoFundMe, Patreon

- Price comparison tools – for banking services as well as consumer purchases, like Moneyfacts, Trivago, Cheapshark

- Investment applications such as Etrade, Interactive Brokers

- Industry-specific CRM tools

- Compliance and regulation technology (RegTech), such as Suade and Alyn

- Security improvements, including biometric data for the credit underwriting process

Some of these areas are now ubiquitous. Others are specialist niches that will only be common knowledge for industry insiders.

Digital Banking

Digital banking has had a revolutionary impact on customer experience in the past decade.

Online banking portals are now a crucial part of consumer expectations. Full-service online banking allows customers to see their statements on demand, make transfers instantly, and interact with chatbots and live staff to resolve problems.

Furthermore, so-called “open banking” has helped customers to use their data in useful and practical ways. Through secure APIs, integration between banks and other financial services has made complex analytical tasks easy for everyone.

The implementation of digital banking has been challenging. When banks fail to fully address customer worries about physical branches closing, they risk upsetting customers who still need to understand how to access the services they need.

As in any digital transformation journey, customers and employees must be at the center.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML have proved their value in diverse applications for financial services. Digital transformation for automation particularly helps enhance customer experience and security without passing on costs to financial services firms.

AI has increasingly been applied to fraud prevention and detection in the financial services industry. Customer behavior is tracked in every transaction, producing data sets far too large for any human to analyze. But AI-powered fraud detection solutions can analyze large datasets quickly and accurately, making them much more effective than traditional fraud detection methods.

On the customer side, AI-powered chatbots now provide customer service for many financial services firms. Bots can provide fast and accurate responses to customer queries, automating mundane tasks while customer service staff focus on more complex customer needs.

Finally, AI data analytics can support decision-making across large and complex financial institutions. With large amounts of past market performance data, management teams can use data analytics to make highly-informed choices about the future. Although this function is not unique to the finance industry, it is a crucial pillar of digital transformation that financial services institutions need to optimize.

Blockchain

Blockchain does impressive things with payment systems. Once upon a time, electronic bank transfers would take anything from hours to days to fully process. Blockchain has the potential to streamline many financial services processes and is already highly effective in its ability to facilitate global payments.

However, blockchain technology is still relatively slow compared to other digital technologies and requires careful implementation.

How New Technologies Are Leading To Decentralized Finance (DeFi)

Regarding digital banking adoption, some consumers are happy with a newer interface for the systems they’ve used in the past. But some consumers feel the need for the whole new system of financial architecture that Decentralized Financed offers.

The DeFi (Decentralized Finance) movement is revolutionizing financial services and introducing new opportunities for digital transformation. DeFi combines decentralized technologies such as blockchain, smart contracts, and digital assets to create a truly open financial system.

Defi’s freely available digital tools present some potential for traditional financial institutions. DeFi enables users to access financial services without centralized control or intermediation. Money-holders are allowed secure and transparent transactions, with peace of mind from bypassing opaque financial institutions.

What Is DeFi?

DeFi is an umbrella term for a wide range of digital initiatives that aim to disrupt traditional finance and banking systems.

DeFi applications are based on blockchain technology and use smart contracts to enable financial transactions and services. DeFi projects are open-source, decentralized, transparent, and accessible to anyone with an internet connection. DeFi offers a range of advantages, including lower transaction costs, faster settlements, and more secure transactions.

DeFi comes with several risks that are unfamiliar to traditional banking methods. After all, this system is contingent on consistent internet availability, largely untested, and primarily unregulated. All the same, the benefits mean that it is likely to be a feature of financial services in the future.

Cryptocurrencies

Like it or not, crypto is now an important part of the financial service landscape. A 2022 Gartner report predicted that by 2024, a fifth of financial transactions would use cryptocurrencies.

Cryptocurrencies are essential to the DeFi movement. By using digital currencies, crypto users can easily make financial transactions with each other, removing the need for banks, authorities, or other intermediaries.

Digital Assets/NFTs

NFTs have become notorious through their association with high-value digital art and collectibles. However, Non-Fungible Tokens (NFTs) play an essential role in the DeFi system.

The most important role of NFTS is tokenizing assets. NFTs can tokenize many assets, including digital art, collectibles, and real-world assets. This allows users to trade securely and transfer ownership of digital assets.

Secondly, they facilitate “smart contracts” that act as digital wallets for digital currencies. This allows users to create automated transactions and agreements, such as lending or borrowing money.

And more generally, NFTs help to increase access to Financial Services. NFTs can enable access to various financial services, such as decentralized exchanges and DeFi protocols, which anyone with an internet connection can access.

Are FSI Companies Evolving Quick Enough?

If the challenges financial services organizations face in digital transformation are significant, the opportunities are even greater. As technology advances and customers demand a more modern and convenient customer experience, companies must embrace change or risk being left behind.

But to stay ahead of the competition, financial service organizations must take a hard look at their operations to identify areas where they need to transform and develop a clear strategy for how to do so. Current industry trends in technology are not just fads. They offer a clear path to improve banking services.

The cultural challenges of digital transformation in financial services companies

An ambitious digital transformation strategy aims at creating a business powered by technology. But an authentic digital business is not just about adding on a few more bits of software to exist. It requires a complete rewiring of processes that may have been established in an organization for years or even decades.

That’s why organizational culture can be a stumbling block for digital transformation in any industry. While more and more companies are built from the ground up with digital services in mind, others need help to keep up.

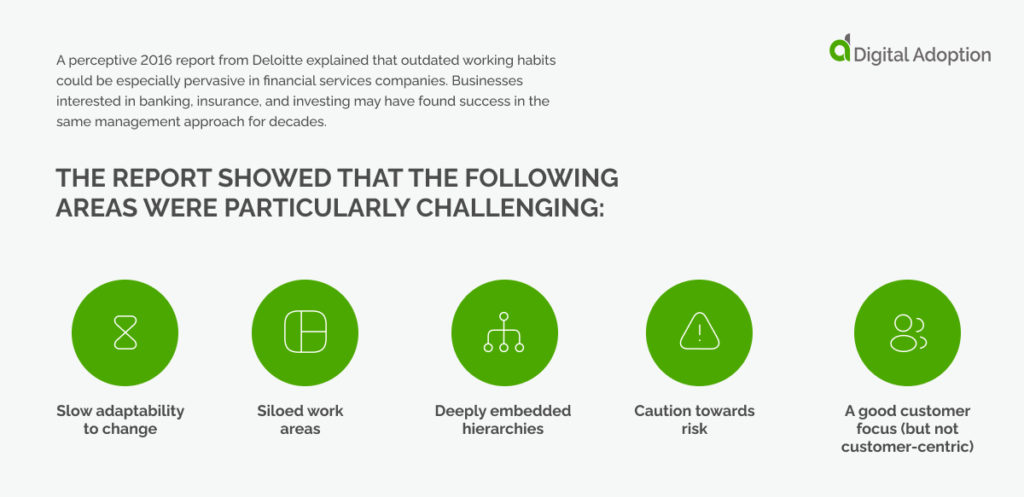

A perceptive 2016 report from Deloitte explained that outdated working habits could be especially pervasive in financial services companies. Businesses interested in banking, insurance, and investing may have found success in the same management approach for decades. The report showed that the following areas were particularly challenging:

- Slow adaptability to change

- Siloed work areas

- Deeply embedded hierarchies

- Caution towards risk

- A good customer focus (but not customer-centric)

An excellent digital transformation strategy needs an agile, collaborative, and exploratory culture, with customer experience at the heart of every decision.

So when it comes to digital transformation, large financial services companies have a difficult job.

Digital transformation for medium-sized companies

To implement a successful digital transformation, the size of a company makes a big difference. Large organizations have to allocate resources to intensive decision-making about their company culture. The smallest businesses may have an advantage, as they can quickly take stock of their situation and easily evaluate the success of any strategy in real time.

Medium-size financial services companies are in a uniquely challenging position.

They may be firmly established in older practices and habits, with a customer base who respects and appreciates their services. But they will need more resources to invest in developing their workplace culture and customer experience.

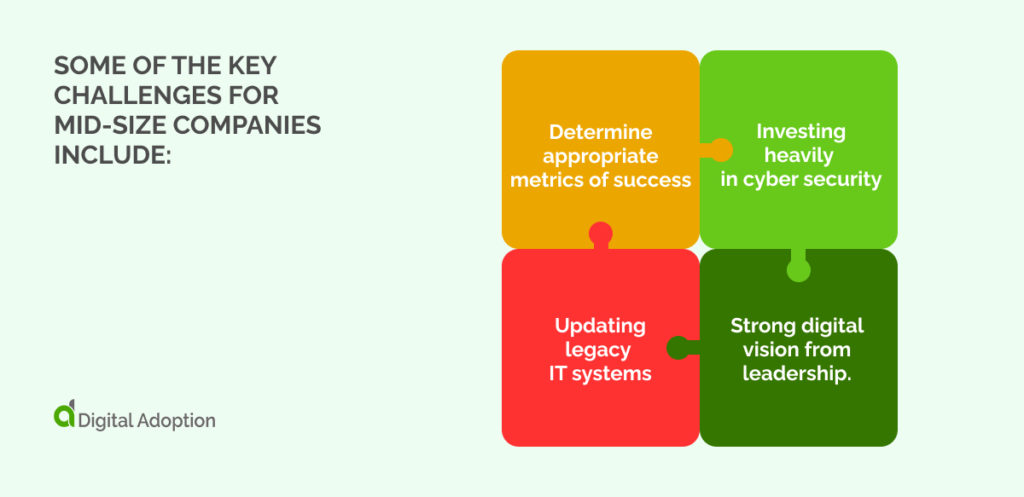

Some of the key challenges for mid-size companies include:

- Determine appropriate metrics of success

- Investing heavily in cyber security

- Updating legacy IT systems

- Strong digital vision from leadership.

Mid-size companies are likely to be risk-averse, thus limiting their adaptation to a digital marketplace. They must take advantage of the opportunities that new technologies offer.

How Financial Services Companies Can Turn Digital Disruption Into Digital Transformation

The importance of digital transformation is now a fact of life. Many institutions will approach new technology as an unwelcome disruption. Others will simply replace legacy systems without considering any alternative business model.

Financial services firms will only have a successful digital transformation if they make digital business central to their work.

In other words, financial organizations must ensure they are adequately preparing for the future with a digital transformation strategy that makes them ready for technological change.

Digital Transformation: Financial Services and The Future of Technology

The benefits of digital transformation for the financial services industry are clear. Successful digital transformation help to create excellent employee experiences, improved security, and growth in their customer base.

Many financial services institutions have already begun their digital transformations, but more work still needs to be done. To remain competitive in the future, financial service companies need to develop an excellent digital transformation strategy that encompasses all aspects of the customer experience.

It needs to be more than just catching up with yesterday’s technology. After all, the financial services landscape has changed dramatically since the advent of digital solutions, and the pace of change shows no sign of slowing down. Financial services providers must follow digital transformation trends and adapt their services to the future of technology.

Only by planning for a successful digital transformation can financial firms ensure that they are prepared for the challenges of tomorrow. By leveraging digital technologies such as cloud computing, artificial intelligence, and blockchain applications, financial services organizations create more efficient processes that reduce costs with enhanced customer experiences.